Table of Content

The HOLC stopped its lending activities in June, 1936, by the terms of the Home Owners' Loan Act. The historian David Kennedy did not exaggerate in claiming that the HOLC and the housing legislation it set in motion "revolutionized the way Americans lived." Diminished wages, widespread unemployment, and few, if any, refinancing options made it difficult for home owners to meet monthly mortgage payments during the Great Depression.

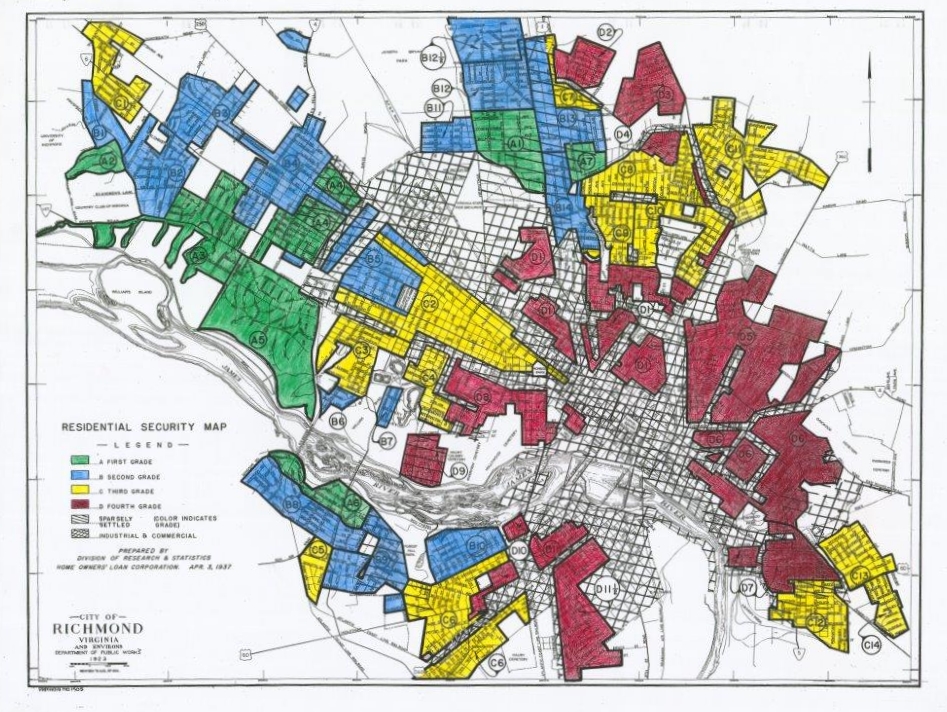

The loans were purchased to homeowners who were having difficulties paying the bills on the mortgage loan “through not their fault”. A majority of the lenders profited from selling their loans since the HOLC bought the loans offering bonds with a value equal to the principal due by the borrower. The loan’s value represented the value of the loan which was refinanced to the borrower. The borrower benefited because they received a loan with an extended time frame and an interest rate that was lower. The lowest rated neighborhoods—those with high concentrations of racial minorities—were "redlined" by the HOLC, a term denoting an area considered too risky for government mortgage assistance. Redlining was adopted not only by private lenders, but also by public agencies, most notably the Federal Housing Administration , which was part of the National Housing Act of 1934.

Home Owners Loan Corporation (HOLC)

The Home Owners' Loan Corporation created by the Roosevelt administration was initiated to prevent home foreclosure in the United States. Though the actual agency was not liable for "redlining" it did provide regulatory structure for racial bias in the private mortgage industry. A common definition of redlining states that it is the practice of denying or limiting financial services in certain neighborhoods based on racial or ethnic composition without regard to applicants’ creditworthiness. It refers to the red line used to mark communities where financial institutions were not likely to invest. Ultimately, more than 800,000 people repaid their HOLC loans, and many repaid them early enough.HOLC officially ceased operations in 1951, when its last assets were sold to private lenders. The HOLC issued bonds and used the bonds to acquire loan mortgages from lending institutions.

At the same time, they enabled banks, insurance companies, savings and loan associations and other real estate investors to exchange defaulted mortgages for $2 3/4 billion in cash and Government bonds. This new life blood saved many hundreds of financial institutions--permitting them to pay off their depositors or investors as necessary and to remain in business. The Home Owners' Loan Corporation was a government-sponsored corporation created as part of the New Deal. The corporation was established in 1933 by the Home Owners' Loan Corporation Act under the leadership of President Franklin D. Roosevelt. Its purpose was to refinance home mortgages currently in default to prevent foreclosure, as well as to expand home buying opportunities.

Does the FHA still exist today?

HOLC was established as an emergency agency under Federal Home Loan Bank Board supervision by the Home Owners’ Loan Act of 1933, June 13, 1933. Foreign Exchange Regulation Act to regulate certain payments dealing in foreign exchange, securities, import & export of currency. National Industry Recovery Act It set up the National Recovery Adminstration and set prices, wages, work hours, and production for each industry. The Great Depression and Credit During the Great Depression of the 1930s, thousands of banks folded, robbing millions of Americans of their savings. Savings in banks were never insured, and as more people and businesses tried to withdraw their funds, the banking crisis intensified. As long as all parties knew the seller was becoming a cosigner and was being removed from the deed, and the lender would lend the money under these conditions.

HOLC was officially shut down in 1951, after its last assets were transferred in 1951 to lenders from the private sector. These questions are approached through the spatial analysis of the HOLC map archive, and the degree to which the old grading corresponds with current neighborhood economic and racial/ethnic status. This is then compared with overall city-level indicators of segregation and economic inequality.

Did the HOLC refinanced mortgages?

In the depression years, they scrimped and sacrificed to meet their monthly payments; in later years, when times were better, they often made payments in advance--many paying off their debts in full far ahead of schedule. The act, which went into effect on June 13, 1933, provided mortgage assistance to homeowners or would-be homeowners by providing them money or refinancing mortgages. The Corporation lent low-interest money to families in danger of losing their homes to foreclosure. The National Housing Act paved the way for the creation of the Federal Housing Authority and the Federal Savings and Loan Insurance Corp. , which helped low-income families buy homes. The FSLIC insured mortgages, making it possible for federally chartered lenders to give out long-term loans.

That bias, shared by private sector bankers and realtors, excluded most minorities from much consideration. Typifying the plight of the cities, the half of Detroit where blacks lived was excluded outright, as was a third of Chicago. This federal emergency agency offered mortgage assistance to homeowners by lending low-interest funds to refinance mortgages, as well as creating new mortgages. HOLC issued bonds insured by the government to local lenders to pay for delinquent mortgages on their portfolios. Home Owners' Loan Corporation was a former agency of the U.S. government. It was a New Deal agency established in 1933 to help in stabilizing real estate that had depreciated during the depression and to refinance the urban mortgage debt.

Related Legal Terms

Some scholars have argued that the maps and codification of appraisal practices introduced by the HOLC bolstered “redlining” as a pattern in government mortgage lending (Jackson 1987; Massey and Denton 1993). From this evidence it appears that the residential security maps were not used by the HOLC to qualify mortgage refinancing; however, it is unclear to what degree the maps may have been used later, by FHA appraisers. Greer’s 2014 analysis extends beyond the HOLC maps themselves to encompass later FHA mortgage risk maps of Chicago, finding that those maps directly impacted lending decisions, barring loans over larger sectors of the city.

By that time, the HOLC had made 1,021,587 loans, making it the owner of approximately one-sixth of the urban home mortgage debt in the United States. The HOLC's operations were not officially terminated until February 3, 1954. Eighty years ago, a federal agency, the Home Owners’ Loan Corporation , created “Residential Security” maps of major American cities.

Home Owners’ Loan Corporation; Provided mortgage assistance to homeowners or would-be homeowners by providing them money or refinancing mortgages. In the end, more than 800,000 homeowners repaid the HOLC credit, but a majority were able to repay them before the due date. This is in contrast to interest-only loans during the 1920s when the borrower made payments of the same amount as the amount of interest every month until the expiration of the loan, and then pay the principle at the conclusion the term of loan. Before the 1930s, loan the borrower would usually pay the principal due by borrowing new loans.

HOLC was established as an emergency agency under Federal Home Loan Bank Board supervision by the Home Owners' Loan Act of 1933, June 13, 1933. It was transferred with FHLBB and its components to the Federal Loan Agency by Reorganization Plan No. It was assigned with other components of abolished FHLBB to the Federal Home Loan Bank Administration , National Housing Agency, by EO 9070, February 24, 1942. Its board of directors was abolished by Reorganization Plan No. 3 of 1947, effective July 27, 1947, and HOLC was assigned, for purposes of liquidation, to the Home Loan Bank Board within the Housing and Home Finance Agency. It was terminated by order of Home Loan Bank Board Secretary, effective February 3, 1954, pursuant to an act of June 30, 1953 (67Stat.121). Since Kenneth T. Jackson's work in the 1980s, scholars have increasingly portrayed HOLC as a key promoter of redlining and a driver of racial residential segregation and racial wealth inequality in the United States.

African Americans suffered disproportionately under the Great Depression. The programs created to ameliorate some of the effects of the economic crash benefited poor whites but blocked poor Black Americans. Housing remained one of the key mechanisms for enforcing the racial divide in the United States, but the programs created to help poor Americans move up became the means of keeping African Americans segregated and restricted.

No comments:

Post a Comment